HOME IMPROVEMENTS

Projects That Qualify For Florida PACE Funding

The Florida PACE (Property Assessed Clean Energy) Program helps homeowners fund critical home improvements like roof replacements, HVAC upgrades, hurricane protection and more through property-based financing with no upfront costs and no credit score requirements.

Whether you’re replacing old windows, reinforcing your doors or improving energy efficiency, PACE makes it easier to move forward with the repairs and upgrades your home needs.

Wide eligibility: Covers major upgrades like roofing, HVAC, windows, doors, storm protection and more

No upfront costs or credit checks: Start your project without tapping into savings or relying on your credit score

Property-based repayment: Fixed-rate terms paid over time through your property tax bill

Accessible to more homeowners: No minimum credit score, income proof or lengthy approvals required

Trusted local contractors: Whether you choose your own or work with a PACE-approved contractor, you’re in control

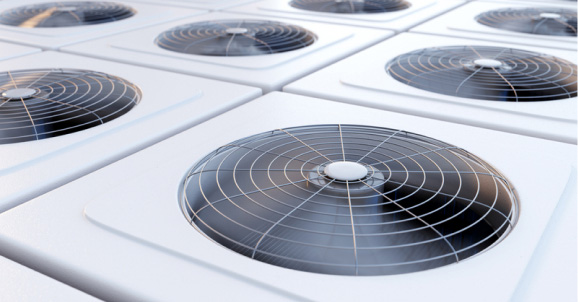

HVAC Heating and Cooling

In Florida, a broken or malfunctioning air conditioning unit or related issue could be a nightmare. Choose from various PACE-funded HVAC home improvements, including central air conditioning, duct installation or replacement, duct sealing, ventilating fans and much more.

Hurricane Protection and Shutters

Prepare for hurricane season by protecting your home before a major storm. From high-impact windows to wind-resistant doors, roofing solutions and hurricane shutters, keep your home protected from storm damages that can lead to larger and more expensive repairs.

Windows and Doors

Are your windows and doors withstanding the test of time? It may be time to replace them if you are experiencing signs of wear and tear that result in the exposure of your home, leaks, unwanted pests and more. Fund your windows and/or doors home improvement project with Florida PACE to improve your energy efficiency, reduce insurance premiums, increase safety and ensure the longevity of your home’s safety.

Roofing Replacements & Repairs

Has a Florida storm left your roof damaged and unsafe? Protect your roof from any further damages with a Florida PACE-funded home improvement roof repair or replacement. Our PACE contractors repair all roofing-related damages such as shingles, granule loss, water leaks, gutters, downspouts, supports/accents and more.

Pool Pumps

Did you know that your pool pump is at the heart of your swimming pool’s functionality? In Florida, your pool pump will typically last for about 8-12 years before needing to be replaced. When you fund a pool pump home improvement through Florida PACE funding, your pool will be equipped with a modern-day, energy-efficient pump that will not only keep your pool in working condition but could save you thousands.

Solar Panels

More and more homeowners are choosing to upgrade to solar-powered solutions. Installing solar panels on your home significantly reduces utility bills over time and increases your home’s overall value. You can make the switch to solar energy by funding your home improvement project through the Florida PACE program and could save thousands of dollars over your lifetime.

Electric Car Chargers

If you are the owner of an electric vehicle, it’s worth considering the installation of an electric car charger in your home. Through Florida PACE funding, you can finance an energy-efficient electric car charger that reduces the cost and hassle of charging your vehicle at a public charger — plus this home improvement could boost your overall home value!

Garage Doors

Upgrading your garage door with extra hurricane protection is one of the best investments you can make as a homeowner. Avoid costly hurricane damages like roof damage and water leaks when you fully replace your garage door or install aluminum bracing kits. This ensures protection against high winds that could de-pressurize your home and result in further damage to other parts of your home.

Water Heaters

Did you know that water heating is the second-largest utility expense in the average American home? With the typical U.S. family using about 64 gallons of hot water a day, investing in an energy-efficient water heater could save you thousands over time. Additionally, an energy-efficient water heater can last more than 20+ years, making the long-term investment worthwhile — finance yours through Florida PACE funding.

Generators

Florida residents are no strangers to storms that cause lengthy power outages. When you own a standby generator, you’re equipped with a backup power source so you can continue to supply power to your most essential appliances until the electricity is restored in your area. Don’t wait until a tropical storm or hurricane strikes. Finance a standby generator through Florida PACE funding, so you’re prepared for a power outage at any time.

Septic System

Septic problems can lead to slow drainage, costly plumbing repairs and water contamination. The average septic system processes about 70 gallons of water per person daily. Investing in septic repairs or upgrades can improve your home’s water quality. Finance your septic improvements through Florida PACE for a more sustainable and valuable home.

Septic to Sewer Conversion

Transitioning from septic to sewer can increase your property value and reduce long-term maintenance costs. With much of Florida transitioning away from septic systems by 2030, consider financing your sewer connections through Florida PACE for a more reliable and valuable home.

Flood Mitigation

Known as the hurricane capital of the United States, Florida faces constant threats of flooding. Implementing flood mitigation improvements like seawalls, retaining walls and exterior drainage systems can significantly reduce your risk. These upgrades are especially crucial for homes in flood zones or with a history of flooding. Safeguard your home with flood mitigation improvements through Florida PACE funding today.

Water Conservation for Commercial Properties

Is your commercial property wasting water and money? Implementing water conservation measures can drastically reduce utility costs and environmental impact. Upgrade with irrigation efficiencies, greywater recycling systems and water-saving fixtures. With Florida PACE funding, you can finance these eco-friendly upgrades for immediate benefits such as lower operational costs and increased property value.

Compare Florida PACE to Other Home Improvement Financing Options

We know that home improvement repairs and upgrades are expensive, and that payment plans can be intimidating. That’s why it’s imperative you take your time to compare the options before entering into a long-term funding plan. You should never feel rushed into a decision that you haven’t fully explored. While we know there are various financing options available to you, it’s important you review each of them before beginning your home improvement project.

We’ll help you understand how to finance home improvements and what funding options are available to you so that you can feel good about your financial plan from start to finish.

Use our comparison chart below to compare Florida PACE to the other available funding options — a HELOC, credit cards and cash — so you can enter into your financial agreement stress-free.

PACE

CASH

HELOC

CREDIT CARD

INTEREST RATE

6-12.99%

0%

8.5-15.37%

18-24%

FIXED RATE

Yes

N/A

May Vary

Yes

BALANCE

Reduced Each Year

None

Can Be Interest Only

Revolving Debt

CASH OPTION

No (Only “Qualified Improvements” can be financed, no cash)

N/A

Yes

Yes (with fees)

How Long Can You Finance

Can only finance for the “useful life” of the product being financed

N/A

Usually 30-Year Amortization

Revolving Debt

MINIMUM CREDIT SCORE

No

No

Yes

Yes

PREPAYMENT PENALTIES

No

N/A

Usually No

No

LENGTH OF TIME TO GET APPROVED

Immediate Pre-Approval

0 Days

Multiple Days/Weeks

Very Fast (with good credit)

NUMBER OF UNDERWRITING QUESTIONS

Immediate Pre-Approval

None

Many

Minimal Questions

Not Sure If You Need a Repair, Replacement or DIY Fix?

Start with our quick home improvement quiz to find out what your home really needs — whether it’s a full replacement, a simple repair or a project you can tackle yourself. Once you know, we’ll help you explore if your project qualifies for Florida PACE funding.

No pressure, just honest guidance to help you make the right call for your home.